Economic Benefits

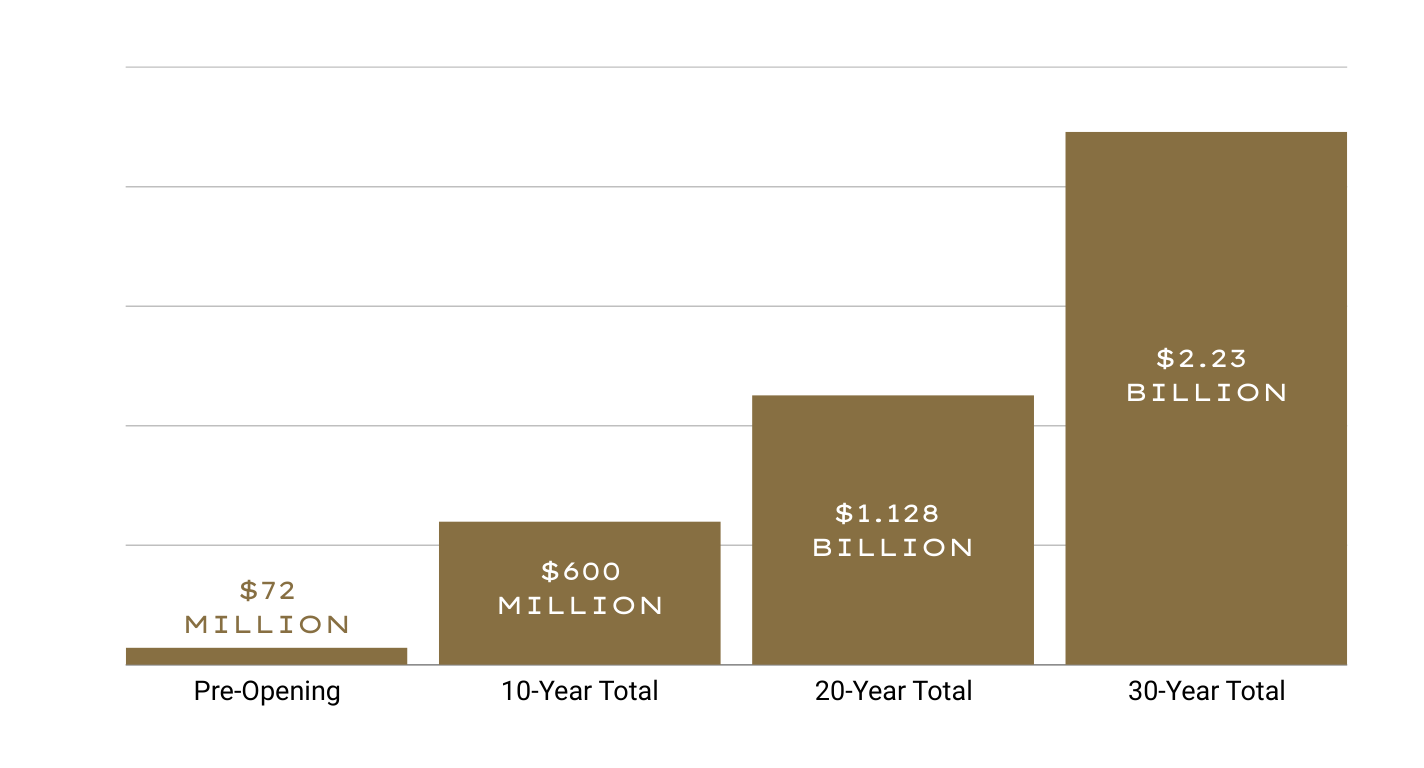

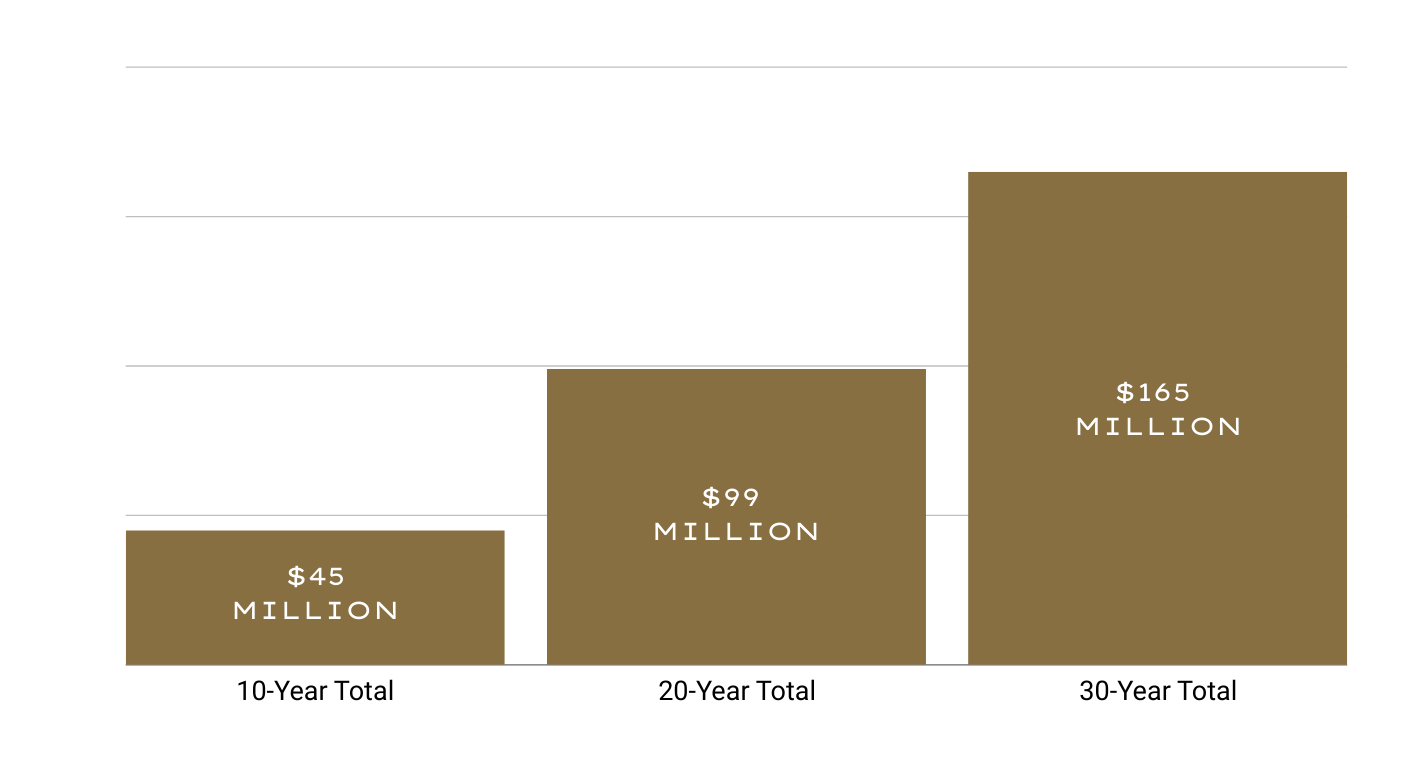

With a New York State Gaming License, Sands New York will contribute a minimum of $1 billion in payments to Nassau and Suffolk counties, the Town of Hempstead, and police and community service organizations over the first 10 years of operation.

In the years that follow, payments are subject to escalators such that the project is estimated to contribute a minimum of $3.474 billion to the Long Island community in its first 30 years of operation.

Funding Commitments to County and Local Government and Community

Funding Commitments to Nassau County

Inclusive of rent and guaranteed minimum share of gaming tax

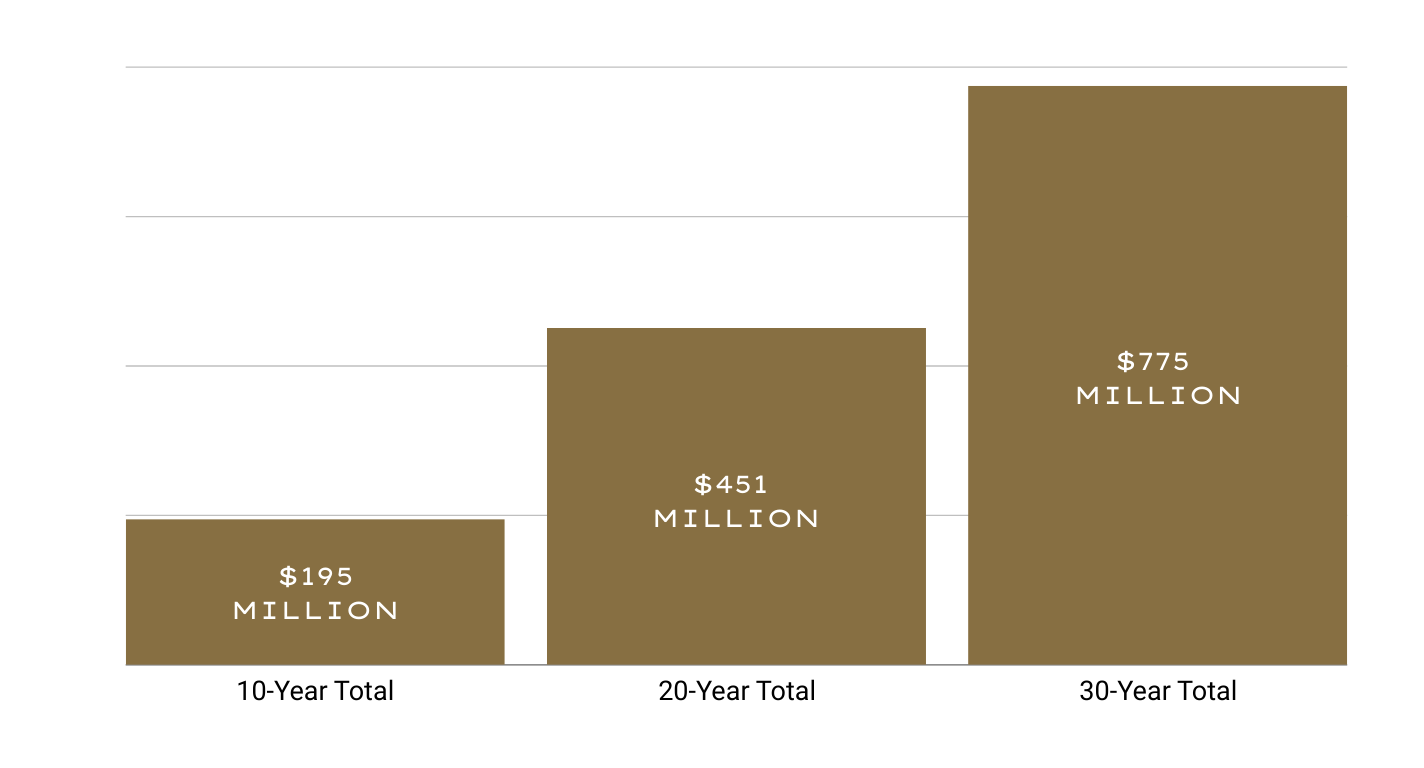

Funding Commitments to the Town of Hempstead

Guaranteed minimum share of gaming tax

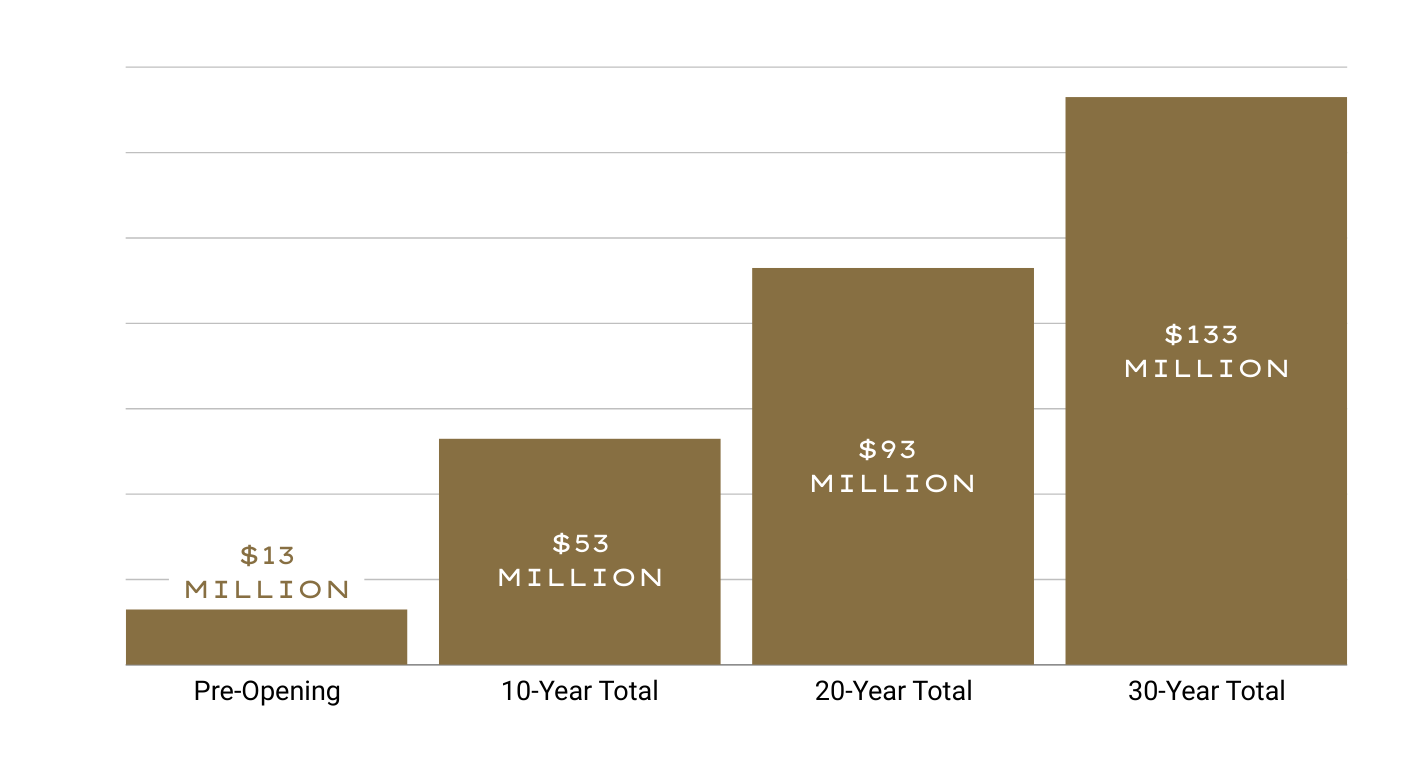

Funding Commitments for Community Benefits

40% of this funding is dedicated to the host community of Uniondale

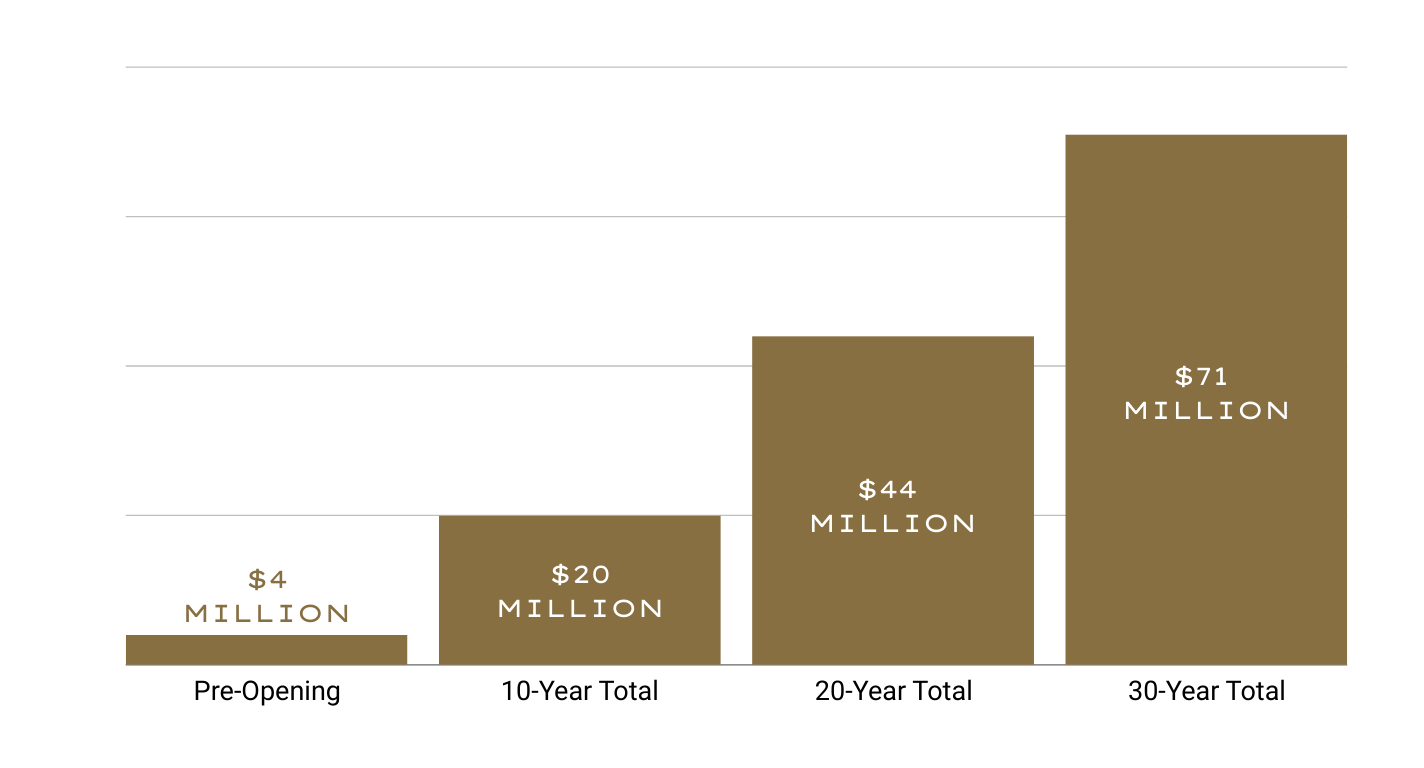

Funding Commitments for Public Safety

Estimated Payment in Lieu of Taxes (PILOT)

Includes payments to the Uniondale School District

5% of the gaming tax revenue.